IRD : Launch of Pillar Two Portal

Jan 19, 2026

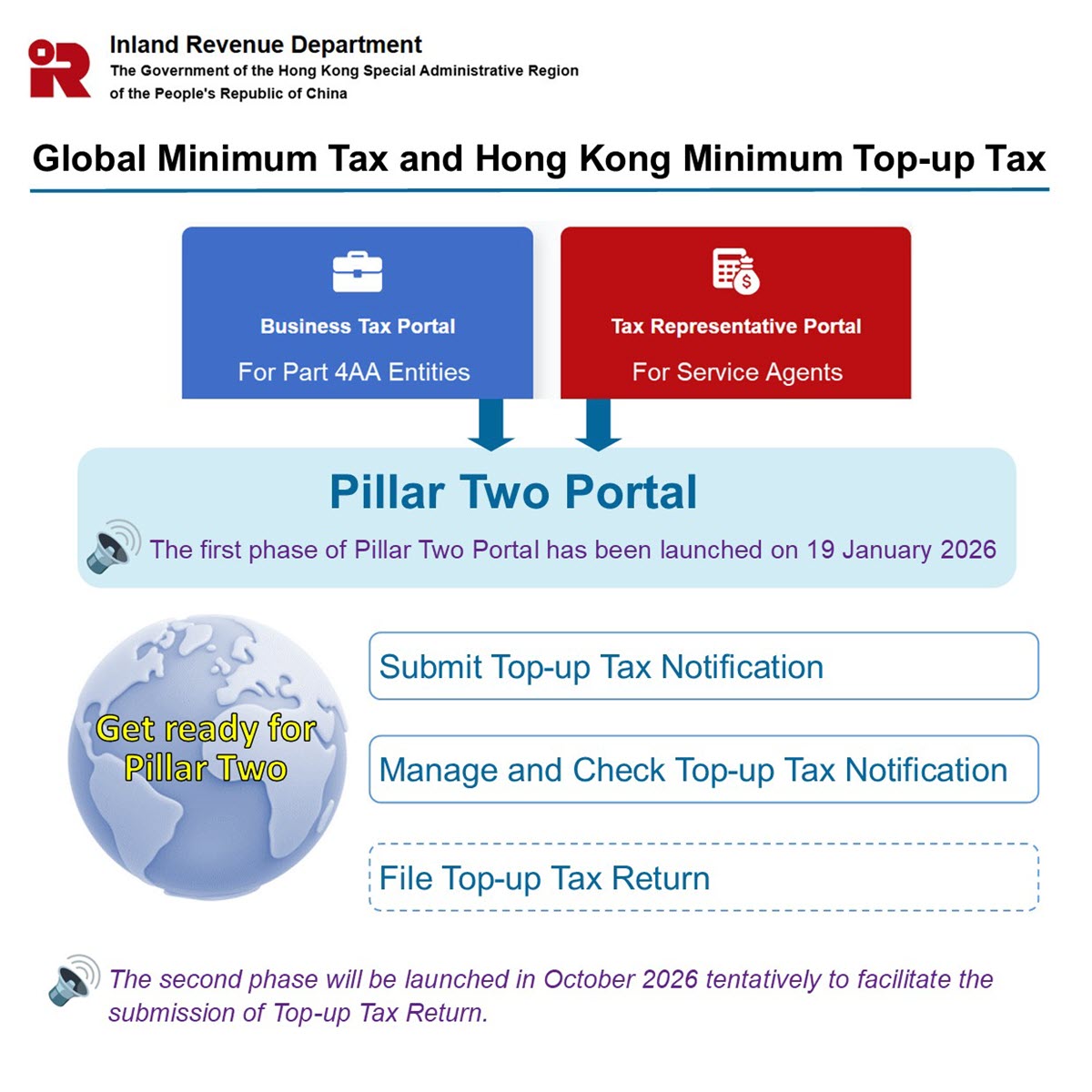

To facilitate Part 4AA entities of an in-scope multinational enterprises group to fulfil their global minimum tax (GMT) and Hong Kong minimum top-up tax (HKMTT) obligations, the Inland Revenue Department has launched the first phase of Pillar Two Portal on 19 January 2026 for submission of top-up tax notifications in relation to:

(a) its obligations of filing top-up tax return;

(b) the entity and jurisdiction from which Hong Kong will receive the GloBE Information Return; and

(c) the local entities for which the obligation to file the top-up tax return will be lifted.

Indeed, Pillar Two Portal is an extended service portal under the Business Tax Portal (BTP) and Tax Representative Portal (TRP). Part 4AA entities and service agents are required to possess their BTP Business Account and TRP Business Account respectively for accessing the Pillar Two Portal. Part 4AA entities and service agents are encouraged to register for BTP /TRP early.

The second phase of the Pillar Two Portal to submit top-up tax return and to receive top-up tax assessments will be launched in October 2026 tentatively. Please stay tuned for our announcement.

Find more about the implementation framework of the GMT and HKMTT regime in Hong Kong:

e-Global minimum tax and Hong Kong minimum top-up tax for multinational enterprise groups

(This post is published on behalf of the IRD.)